operating cash flow ratio industry average

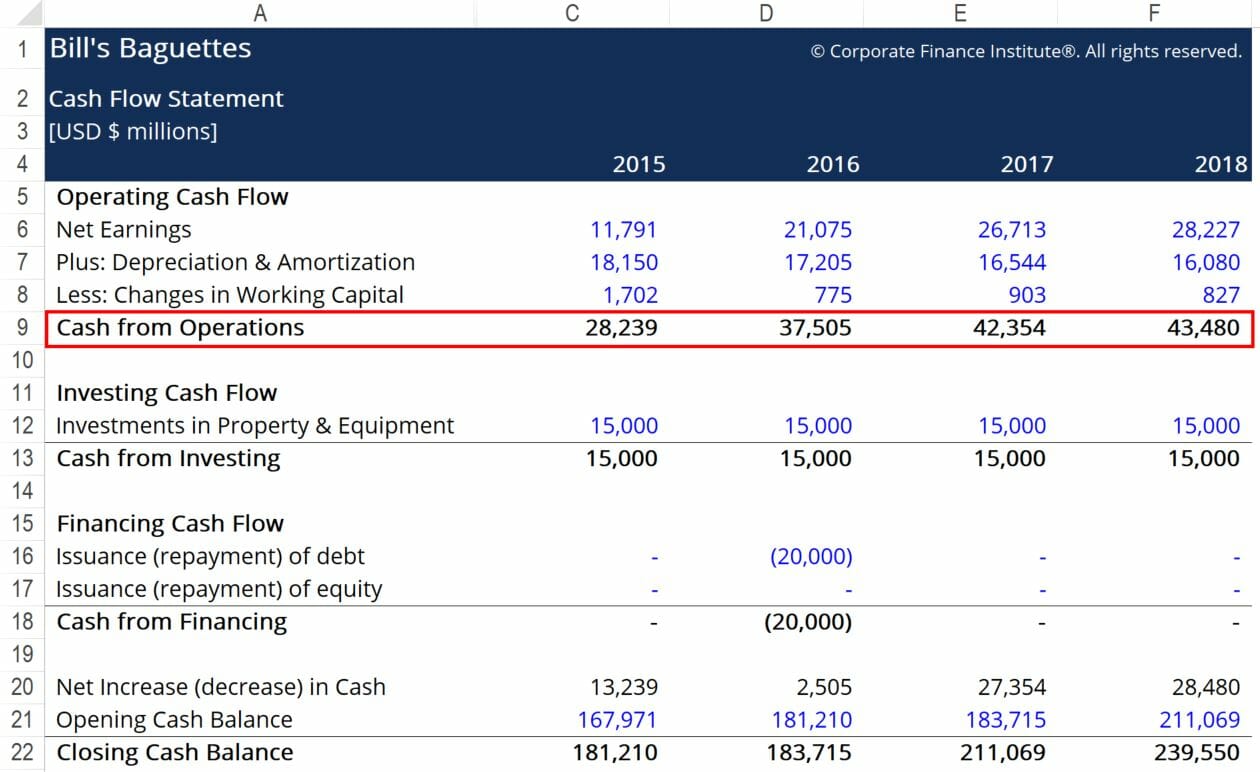

Financial Soundness 36-51 39. Cash flow coverage ratio Net Earnings Depreciation Amortization Total Debt.

Operating Cash Flow Ratio Formula Guide For Financial Analysts

For example free cash flows can be used instead of operating cash flows.

. Industry Comparisons RMA SP DB Local Trade Group. Following are the formulas used to calculate key financial ratios. In the second category ratios used to assess a companys strength on an ongoing basis we like total free cash TFC cash flow adequacy CFA cash to capital.

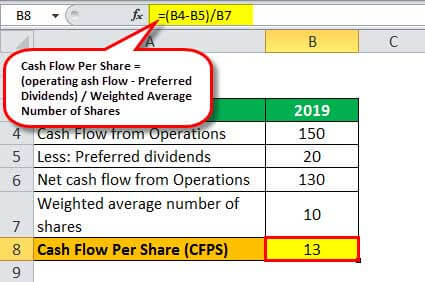

Operating cash flow indicates whether a company can generate sufficient positive. During the past 13 years Callaway Golf Cos highest 3-Year average Operating Cash Flow per Share Growth Rate was 16360 per year. Far and above the most valuable liquidity ratio is the operating cash ratio.

During the past 3 years the average Operating Cash Flow per Share Growth Rate was 1830 per year. Its primary element the numerator in this formula is. Operating CFCurrent Liabilities.

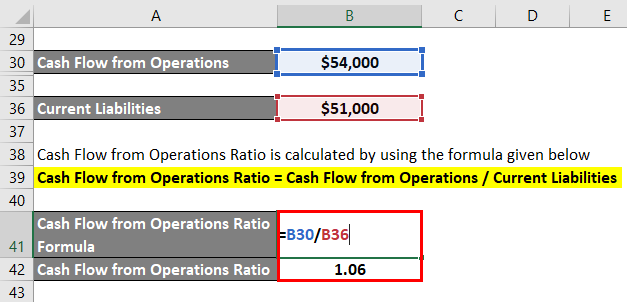

The formula for calculating the operating cash flow ratio is as follows. The Operating Cash to Debt Ratio measures the percentage of a companys total debt that is covered by its operating cash flow for a given accounting period. Pretret_noa Profitability Operating Income After Depreciation as a fraction of average Net Operating Assets NOA based on most.

220 rows An acceptable current ratio aligns with that of the industry average or. WRDS Research Team. Operating cash flow ratio is generally calculated using the following formula.

Industry Comparisons 2017 Industry Average Current 27X Quick 10X Inventory turnover 61X. The operating cash flow refers to the cash that a company generates through its core operating activities. 75 rows Cash Ratio - breakdown by industry.

Retail Sectors pace of cumulative 12 months Free Cash Flow growth in 1 Q 2022 accelerated to 1674 year on year above Sector average. Targets operating cash flow ratio works out to. Cash ratio is a refinement of quick ratio and.

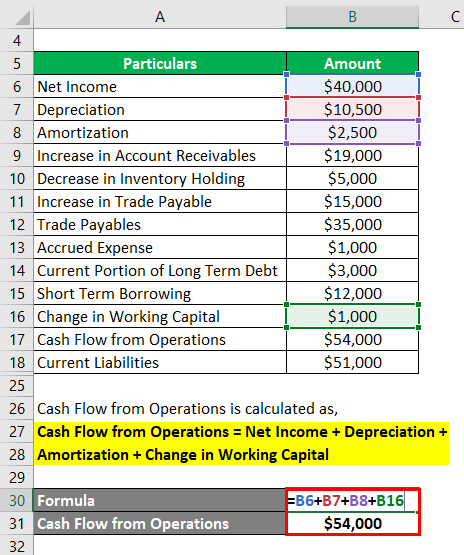

This will be a more conservative ratio which provides for the capital expenditure. Sequentially TTM Free Cash Flow grew by 284. Operating cash flow OCF is a measure of the amount of cash generated by a companys normal business operations.

Free Cash Flow growth YY Annual Comment. In the first liquidity indicators the most useful ratios are operating cash flow OCF funds flow coverage FFC cash interest coverage CIC and cash debt coverage CDC. Indeed the ten sub-sectors with the lowest cash at 5-8 of sales commanded an operating margin averaging just 6.

WRDS Industry Financial Ratio. XYZ Corp in contrast has an operating cash flow of 20 billion and is only 16 billion in debt. This resource is only available to current UTSA faculty students and staff.

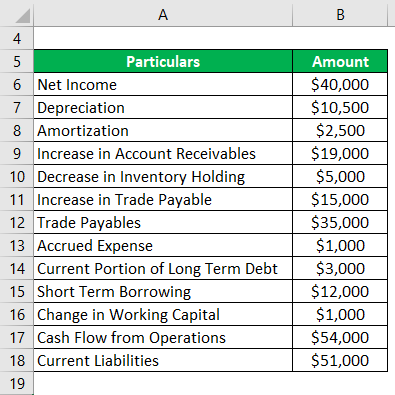

The Times Interest Earned Ratio is. Its cash flow-to-debt ratio is a more solid 125. Operating cash flows also known as cash flow from operations converts net income to cash income.

Hence the industry seems to be overall liquid. Meaning the interest of The Learning Company was covered 9 times. Operating Income also known as Operating Income Before Interest Expense and Taxes divided by Interest Expense Times Interest Earned Ratio.

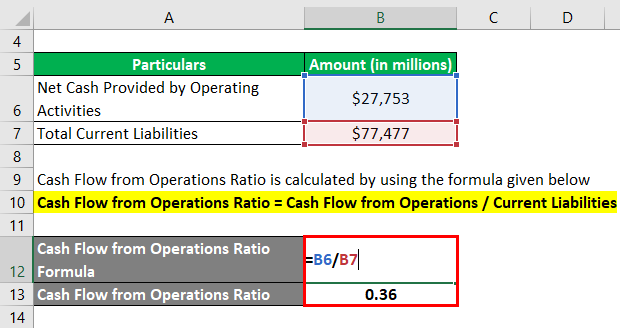

Another formula used for the calculation of cash flow coverage ratio is. Other Issues in Key Ratio Analysis 1. The operating cash flow ratio for Walmart is 036 or 278 billion divided by 775 billion.

Cash flow from operations can be found on a companys statement of cash flows Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. Free Cash FlowOperating Cash Flow. Liquidity Activity Leverage Operating Performance and Cash flow.

In 2014 Times Interest Earned was. Other Ratios 69-72 70. Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance sheet.

The operating cash flow ratio is not the same as the operating cash flow margin or the net income margin which includes transactions that did not involve actual transfers of money depreciation is common example. During the past 5 years the average Operating Cash Flow per Share Growth Rate was 1640 per year. Operating Cash Flow Ratio Operating Cash Flow Current Liabilities.

The cash conversion ratio is calculated as operating cash flowEBITDA. The average current ratio of the industry is 1186 which is more than one. This ratio also has some variations.

On the trailing twelve months basis. Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow. Alternatively the formula for cash flow from operations is.

Further there is significant inventory in the balance sheet of Walmart Inc the Kroger Company and the Walgreen boots alliance. Operating Cash Ratio Formula and Understanding. This usually represents the biggest stream of cash that a company generates.

Financial Ratios Industry Level in WRDS Financial Ratios Industry Level by WRDS Beta Please note. Operating cash flow ratio measures the adequacy of a companys cash generated from operating activities to pay its current liabilitiesIt is calculated by dividing the cash flow from operations by the companys current liabilities. On the trailing twelve months basis Oil And Gas Production Industrys Cash cash equivalent grew by 2363 in the 4 Q 2021 sequentially faster than Current Liabilities this led to improvement in Oil And Gas Production Industrys Quick Ratio to 03 in the 4 Q 2021 Quick Ratio remained below Oil And Gas Production Industry average.

This compares to 14 for those industries with the largest cash balances at 20-40 of sales. The cash conversion ratio CCR compares a companys operating cash flows to its profitability and measures a companys efficiency in turning its profits into cash. It has a cash flow-to-debt ratio of 025 which means it would take a whopping four years to pay off its debt 1 divided by 025.

18000 2000 9. WRDS Industry Financial Ratio WIFR hereafter is a collection of most commonly used financial. Free Cash FlowOperating Cash Flow.

Operating Cash Flow Formula Examples With Excel Template Calculator

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Operating Cash Flow Ratio Definition

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Price To Cash Flow Ratio P Cf Formula And Calculation

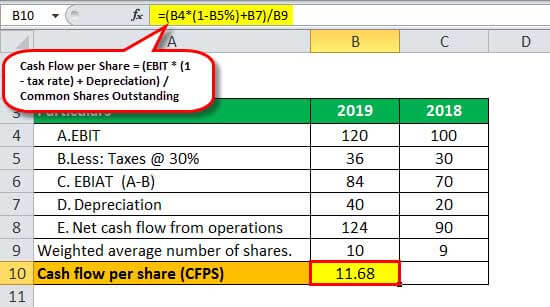

Cash Flow Per Share Formula Example How To Calculate

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Cash Flow Per Share Formula Example How To Calculate

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow Per Share Formula Example How To Calculate