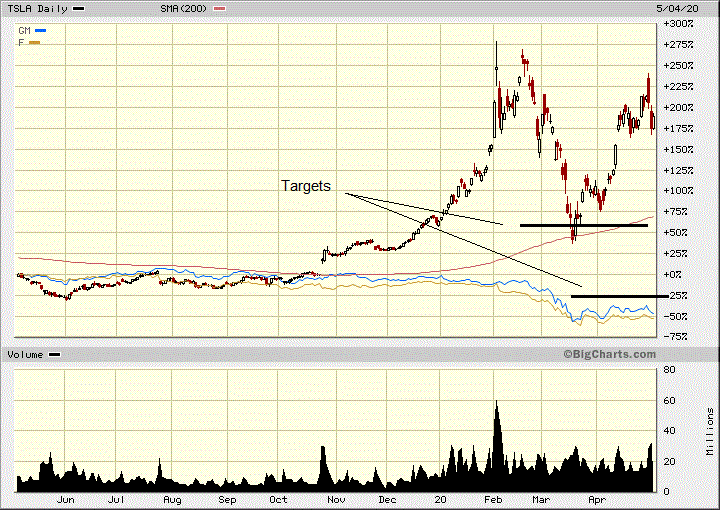

bear trap stock example

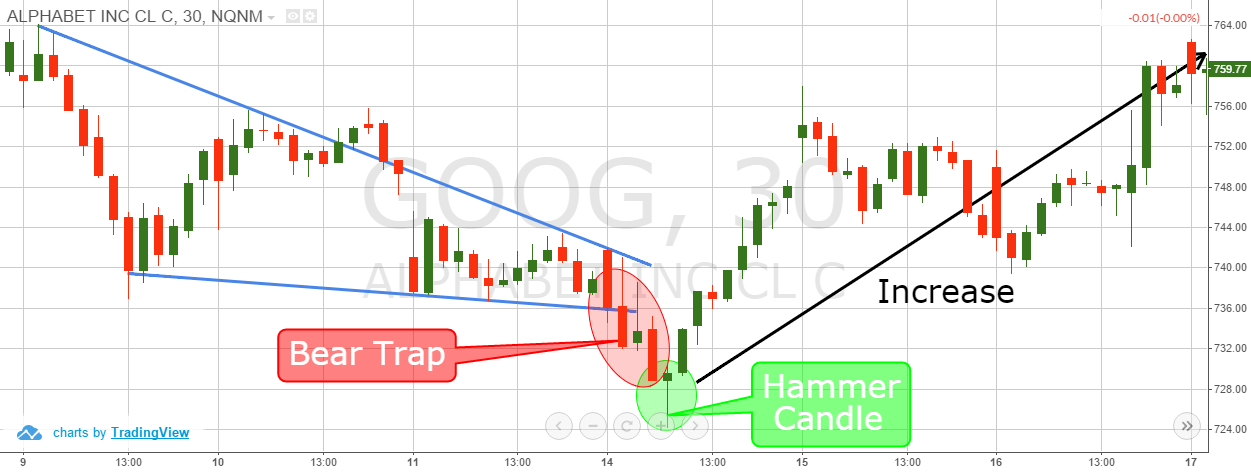

In this example the security sells off and hits a new 52-week low before rebounding sharply on high volume and lifting into trendline resistance. The SP 500 Index dropped more than 20.

Best Strategies To Profit From Bear Trap

In 2021 many investors found themselves caught.

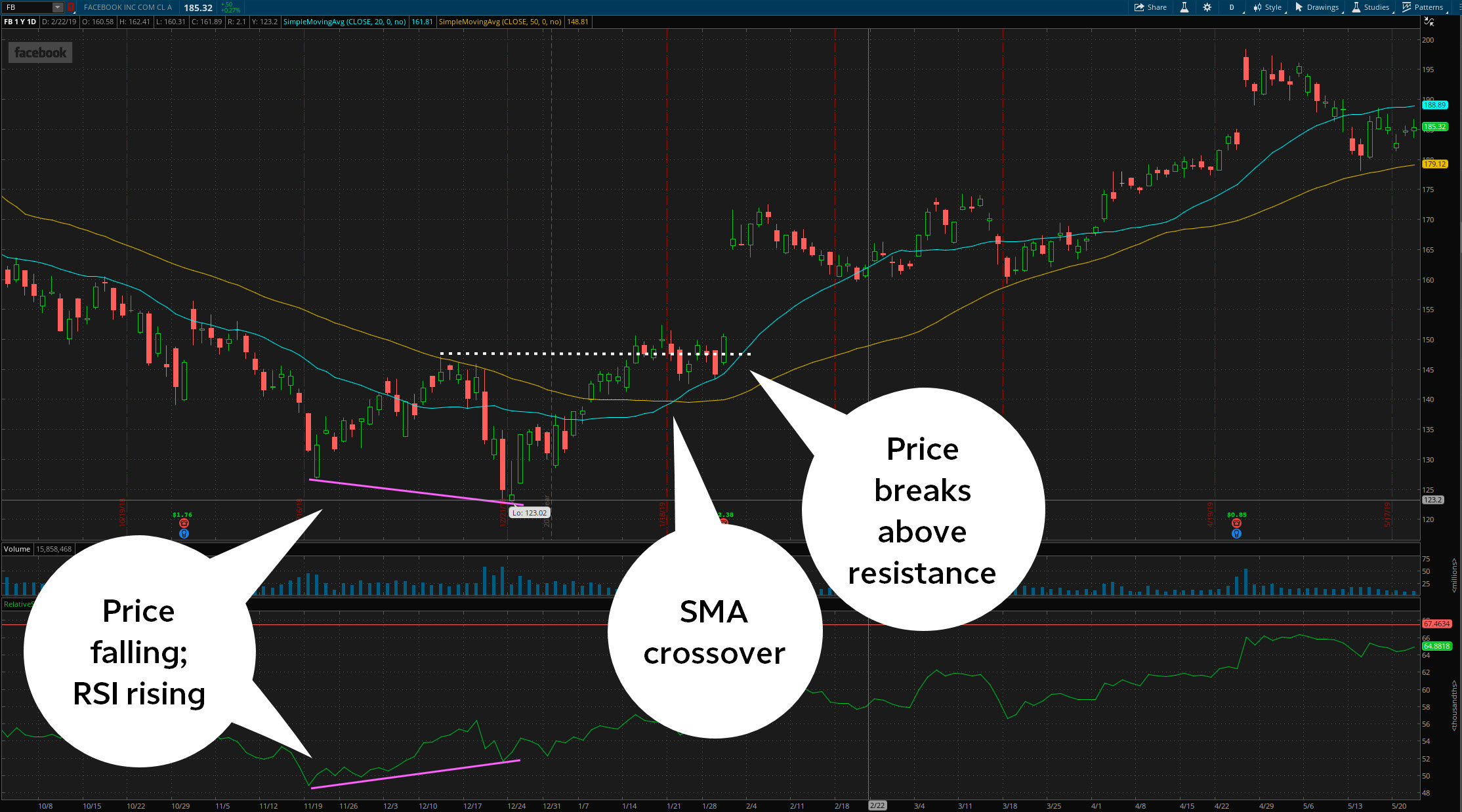

. See real-life trade examples that illustrate how to identify the Bear Trap setup and profit from short squeezes. For example a market that has dropped by 20 or more is often said to be a bear market while a reversal to. Bearish Candlestick Closing Above Support This is the prime example of a bear trap in financial markets.

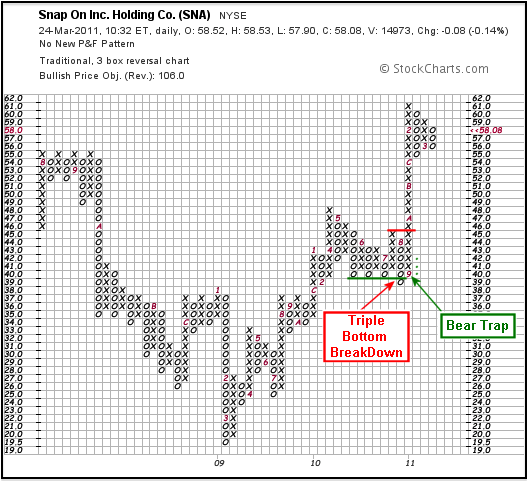

Below is an example of a bear trap on 76 for the stock Agrium Inc. Bear traps typically follow bullish patterns. You will notice that the stock broke to fresh two-day lows before having a sharp counter move higher.

For a bear trap chart example consider a scenario where traders were watching a key support level of 425 on the. Suckers rally bull trap dead cat bounce The most recent example of a bear market rally took place in 2020. If XYZ rises to 100 you.

After the support is put in place just below 084 EURGBP moves higher but finds. Bear trap example Suppose youve been keeping your eye on Company XYZs stock and after an upward trend you see the stocks price has started to slip. Imagine were in the middle of a bull market and youre one of the inexperienced traders looking to cash in on your.

Beatrice is watching a stock thats in a clear ascending triangle pattern. Technical traders use a number of analytical techniques to avoid bear traps. In the example above if you shorted XYZ and the stock is currently worth 50 youd need at least 15 in your account for each share you shorted.

A bear trap is a temporary but sudden downtrend occurring after a long-term uptrend and quickly followed by a sharp rally of the stock. The terms bull and bear also apply to general market movements. A bear trap is common when trading various assets such as stocks currencies and commodities.

A bear trap is a colloquial name for a particular trading pattern in the stock market. Sep 19 2022 0528PM EDT. Essentially its a relatively sudden movement in a stock or in the.

Its a technical pattern where the price dips or starts falling then quickly reverses. Bear Trap Example A typical bear trap works like this. Novice traders start selling their stocks at a much lower.

She believes that when the pattern reaches. Example of a Bear Trap Stock in Action Throughout the COVID-19 pandemic energy company stocks were volatile and difficult to predict. For example Fibonacci retracements relative strength oscillators and volume indicators.

Below is an example of a bear trap on 76 for the stock.

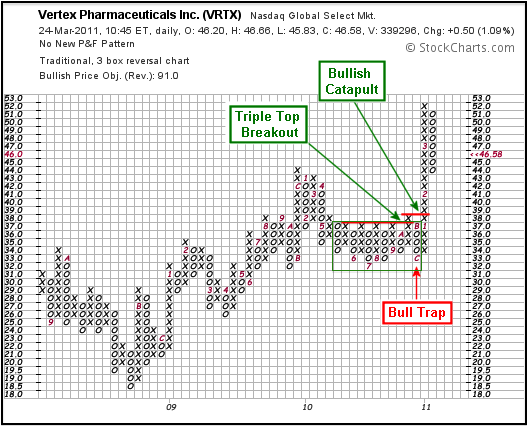

P F Bull Bear Traps Chartschool

Yuriy Matso On Twitter Spy 2009 Vs 2019 This Scenario Can Also Unfold And It Will Crush All Bears And It Will Be Extremely Bullish For The Stock Market Going Forward There

3 Bear Trap Chart Patterns You Don T Know

:max_bytes(150000):strip_icc()/dotdash-a-history-of-bear-markets-4582652-FINAL-45c56ebc095e4815a2c3229b13896a1b.jpg)

A Brief History Of Bear Markets

What Is A Bear Trap Seeking Alpha

What Is Bear Trap Trading And How Does It Work

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

What Is A Bear Trap On The Stock Market Fx Leaders

P F Bull Bear Traps Chartschool

Bear Trap In Trading Explanation For Beginners Gobankingrates

The Bear Trap Everything You Ve Ever Wanted To Know About It Earn2trade Blog

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

How To Avoid A Bear Trap When Trading Crypto Bybit Learn

What Is A Bear Trap Seeking Alpha

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

Bull Trap Best Strategies To Trade Bull Traps Trading In Depth

Bear Trap In Investing Explained All You Need To Know

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap In Trading And How To Identify It Youtube